Major Retirement Planning Milestones

By Nicole Young on August 16, 2023

Make it a priority to stay on track for retirement planning by noting these milestones and deadlines.

As it draws nearer, the prospect of retirement tends to be both exciting and nerve-racking. One factor that makes it more of the latter is the plethora of dates, rules and options one must keep track of to take full advantage of government-sponsored programs and tax benefits. Here are some key milestones to be aware of to help with this feat and the related decisions.

Age 50: Now is your opportunity to maximize your retirement savings by beginning to make annual “catch-up contributions” that exceed the typical limits to retirement accounts including 401(k)s and IRAs.

Age 55: You may now be eligible to leverage what’s been informally coined the “Rule of 55”to begin taking penalty-free withdrawals from certain retirement plans, such as 401(k) accounts, if you are no longer employed. Note that income tax will still apply to these distributions.

Age 59 ½: Early withdrawal penalties on IRA distributions no longer apply ― regardless of whether you are still employed or not. However, income tax will still apply to these distributions.

- TIP: It’s usually prudent to avoid making withdrawals from retirement accounts until you are required to in order to benefit from the tax-deferred growth of your assets for as long as possible.

Age 62: You are now eligible to receive Social Security payments. However, just because you can start collecting Social Security payments doesn’t mean you should.

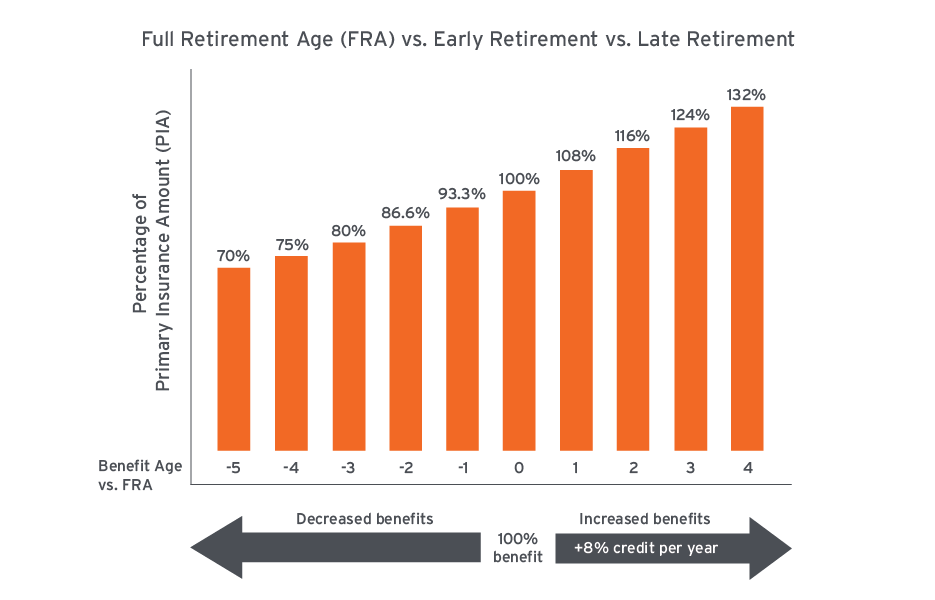

- TIP: While you can begin receiving Social Security as early as age 62, full retirement age (FRA) varies from age 65 to 67 depending on your birth year. If you begin to collect before FRA, your monthly benefits will be permanently reduced. Conversely, if you start after FRA, your monthly benefits will be increased. Therefore, you may want to consider waiting until as long as age 70 to begin collecting in order to maximize your monthly benefit.

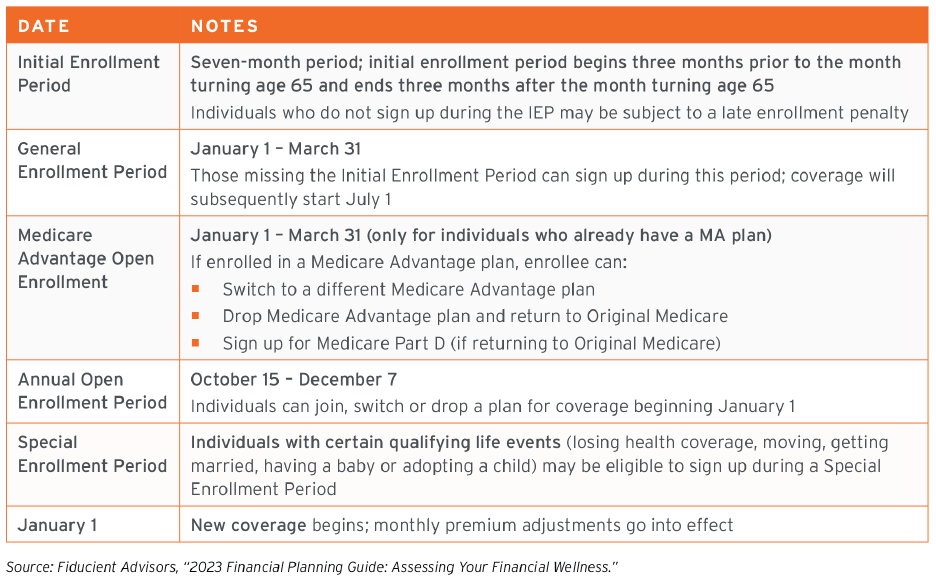

Age 65: Most Americans are now eligible for Medicare. You’re first eligible to sign up three months prior to your 65th birthday, or earlier if you have a disability. Here are important enrollment deadlines to mark on your calendar:

- TIP: Sign up for Medicare on time as delaying enrollment can result in gaps in coverage or a late enrollment penalty fee. If you are collecting retirement benefits from Social Security, you’ll automatically get Medicare Parts A and B coverage the first day of the month you turn 65 (though you can request to drop the coverage in writing). If you’re turning 65 but not ready to begin collecting Social Security, you can still apply for Medicare through the Social Security Administration online at ssa.gov/medicare, by calling 1-800-772-1213, or by visiting your local Social Security office.

Age 66–67: Considered full retirement age for most Americans to become eligible for unreduced Social Security benefits.

Age 70: If you have held out on receiving payments,you are noweligible to receive the maximum Social Security benefit.

Age 73: This is the age at which you must begin taking required minimum distributions (RMDs). You calculate these amounts based on your account balances and life expectancy. Your first distribution is due by April 1 of the year after you reach 73. Subsequent annual distributions are required by the end of each calendar year. According to the IRS, if you do not take these distributions, or if they are not large enough, you may incur a 50% excise tax on the required distribution.

- TIP: If you wait until April 1 of the year after you become 73 to take the first withdrawal, you’ll have to take a second distribution by December 31 of the same year. The additional income from that second distribution could put you in a higher tax bracket and potentially substantially increase your tax bill. Consider these tax implications as you approach this milestone. Also, please note that if you continue to work and do not own more than 5% of the business, you can delay taking RMDs from your 401(k) until the year you retire.

While we hope this outline of milestones is useful, we also understand that it doesn’t make preparing for and making decisions around retirement easy. Please know that we are here to help. Before you celebrate your next birthday, please reach out to us for a checkup to ensure you’ve taken all possible steps toward a financially secure and enriching retirement.